Page 36 - Public Citizen 2021-2022

P. 36

Page 1

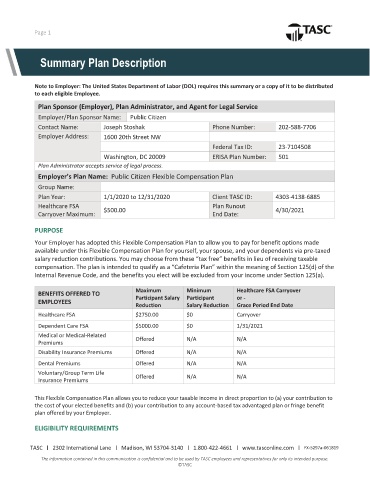

Summary Plan Description

Note to Employer: The United States Department of Labor (DOL) requires this summary or a copy of it to be distributed

to each eligible Employee.

Plan Sponsor (Employer), Plan Administrator, and Agent for Legal Service

Employer/Plan Sponsor Name: Public Citizen

Contact Name: Joseph Stoshak Phone Number: 202-588-7706

Employer Address: 1600 20th Street NW

Federal Tax ID: 23-7104508

Washington, DC 20009 ERISA Plan Number: 501

Plan Administrator accepts service of legal process.

Employer’s Plan Name: Public Citizen Flexible Compensation Plan

Group Name:

Plan Year: 1/1/2020 to 12/31/2020 Client TASC ID: 4303-4138-6885

Healthcare FSA Plan Runout

$500.00 4/30/2021

Carryover Maximum: End Date:

PURPOSE

Your Employer has adopted this Flexible Compensation Plan to allow you to pay for benefit options made

available under this Flexible Compensation Plan for yourself, your spouse, and your dependents via pre-taxed

salary reduction contributions. You may choose from these “tax free” benefits in lieu of receiving taxable

compensation. The plan is intended to qualify as a “Cafeteria Plan” within the meaning of Section 125(d) of the

Internal Revenue Code, and the benefits you elect will be excluded from your income under Section 125(a).

Maximum Minimum Healthcare FSA Carryover

BENEFITS OFFERED TO

Participant Salary Participant or -

EMPLOYEES

Reduction Salary Reduction Grace Period End Date

Healthcare FSA $2750.00 $0 Carryover

Dependent Care FSA $5000.00 $0 1/31/2021

Medical or Medical-Related Offered N/A N/A

Premiums

Disability Insurance Premiums Offered N/A N/A

Dental Premiums Offered N/A N/A

Voluntary/Group Term Life

Offered N/A N/A

Insurance Premiums

This Flexible Compensation Plan allows you to reduce your taxable income in direct proportion to (a) your contribution to

the cost of your elected benefits and (b) your contribution to any account-based tax advantaged plan or fringe benefit

plan offered by your Employer.

ELIGIBILITY REQUIREMENTS

TASC I 2302 International Lane I Madison, WI 53704-3140 I 1.800-422-4661 I www.tasconline.com I FX-5297a-061819

The information contained in this communication is confidential and to be used by TASC employees and representatives for only its intended purpose.

©TASC