Page 30 - Empowered Learning for Dyslexic Children Benefits Guide 2022-2023

P. 30

Investment Options for your HSA

The money you contribute to your HSA grows and earns interest at the rate included with your

HSA plan type. Investment accounts are self-directed and self-managed—you choose where,

when and how much to invest.

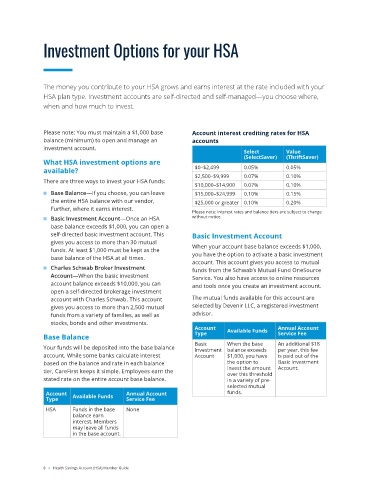

Please note: You must maintain a $1,000 base Account interest crediting rates for HSA

balance (minimum) to open and manage an accounts

investment account.

Select Value

(SelectSaver) (ThriftSaver)

What HSA investment options are

available? $0–$2,499 0.05% 0.05%

$2,500–$9,999 0.07% 0.10%

There are three ways to invest your HSA funds:

$10,000–$14,900 0.07% 0.10%

■ Base Balance—If you choose, you can leave $15,000–$24,999 0.10% 0.15%

the entire HSA balance with our vendor, $25,000 or greater 0.10% 0.20%

Further, where it earns interest.

Please note: Interest rates and balance tiers are subject to change

■ Basic Investment Account—Once an HSA without notice.

base balance exceeds $1,000, you can open a

self-directed basic investment account. This Basic Investment Account

gives you access to more than 30 mutual

funds. At least $1,000 must be kept as the When your account base balance exceeds $1,000,

base balance of the HSA at all times. you have the option to activate a basic investment

account. This account gives you access to mutual

■ Charles Schwab Broker Investment funds from the Schwab’s Mutual Fund OneSource

Account—When the basic investment Service. You also have access to online resources

account balance exceeds $10,000, you can and tools once you create an investment account.

open a self-directed brokerage investment

account with Charles Schwab. This account The mutual funds available for this account are

gives you access to more than 2,500 mutual selected by Devenir LLC, a registered investment

funds from a variety of families, as well as advisor.

stocks, bonds and other investments.

Account Available Funds Annual Account

Base Balance Type Service Fee

Basic When the base An additional $18

Your funds will be deposited into the base balance Investment balance exceeds per year, this fee

account. While some banks calculate interest Account $1,000, you have is paid out of the

based on the balance and rate in each balance the option to Basic Investment

tier, CareFirst keeps it simple. Employees earn the invest the amount Account.

over this threshold

stated rate on the entire account base balance. in a variety of pre-

selected mutual

Account Available Funds Annual Account funds.

Type Service Fee

HSA Funds in the base None

balance earn

interest. Members

may leave all funds

in the base account.

8 ■ Health Savings Account (HSA) Member Guide